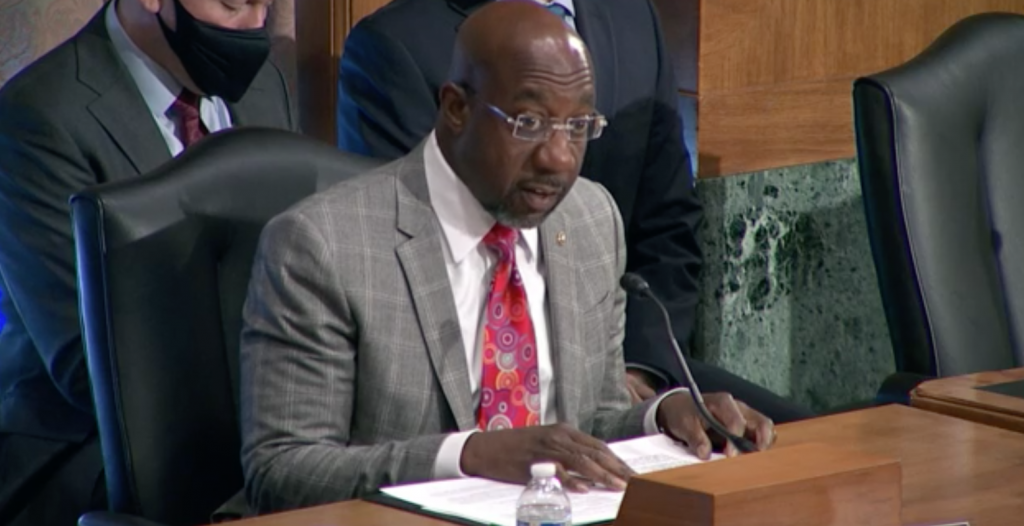

Senator Reverend Warnock joined a letter with Senate colleagues to the Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra highlighting the need to take immediate action on growing medical debt burdens faced by consumers

At Banking committee hearing, Senator Reverend Warnock spoke on the effects that closing the Medicaid coverage gap would have on ameliorating medical debt for Georgians

Senator Warnock is a vocal advocate for strengthening health care access

Senator Reverend Warnock: “In Georgia, there’s over $120 million in medical debt for over 108,000 folks. This is unacceptable. People should not have to choose between getting the prescription drugs they need and groceries”

Washington, D.C. –Yesterday, Senator Reverend Warnock (D-GA), a member of the Senate Committee on Banking, Housing and Urban Affairs, joined his colleagues in sending a letter to Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra highlighting the growing medical debt burden faced by consumers. Specifically, the letter urges the CFPB to use its authority to address the growing medical debt burden faced by U.S. consumers and establish an ombudsman position for consumer medical debt. The ombudsman would help to facilitate consumer complaint resolution and compliance with federal directives, like the ban on surprise medical bills.

Banking Chair Sherrod Brown (D-OH), and Sens. Elizabeth Warren (D-MA), Tina Smith (D-MN), and Jack Reed (D-RI) also signed the letter.

Low-income individuals, Black and Hispanic households, veterans, young adults, and older Americans are more likely to have medical debt and struggle to pay it off. Medical debt is also unlike many other kinds of debt, as many people are forced to incur debt when experiencing a medical emergency or after receiving a surprise bill for a service they believed would be covered by their health insurance.

In Georgia, there is over $120 million in medical debt for over 108,000 individuals.

In addition to the letter, Senator Reverend Warnock emphasized the direct link between states that have yet to expand Medicaid and increased levels of medical debt burdens at a Banking, Housing, and Urban Affairs Committee hearing yesterday on the Economic Impact of the Growing Burden of Medical Debt. At the hearing, Senator Warnock questioned Ms. Berneta L. Haynes, National Consumer Law Center, an Atlanta resident. Below is a highlight of their exchange:

Senator Reverend Warnock: “The Affordable Care Act allowed states to expand Medicaid to over 13 million Americans. This is transformational legislation for our country, but sadly, there are still 646,000 Georgians unable to access free and affordable health care, because state politicians continue to prioritize politics over people. I’ve been fighting for Medicaid expansion long before I came to the Senate. And when I arrived, I fought really hard to get further incentives for Georgia to expand Medicaid, which we won in the American Rescue Plan. And the state continues, state politicians, continue to refuse to expand Medicaid – a net loss to the state and certainly to the 646,000 Georgians in the Medicaid gap. And that’s why after that I introduced the Medicaid Saves Lives Act, which would give folks in states like Georgia access to health care, and I’m fighting to close the coverage gap to ensure that everybody, everywhere, no matter your zip code, has access to health care. Miss Haynes, do we tend to see more medical debt in states like Georgia, that have not expanded Medicaid, then states that have expanded Medicaid?”

Ms. Haynes: “That’s absolutely correct, households in the South, the region with the highest concentration of Black folks, carry more medical debt than other regions. This is exactly the region too, where Medicaid expansion has not really happened. Of the 12 states that have not expanded Medicaid, eight of them are in the South. That’s left many people uninsured, particularly Black folks. Also, many of those Southern states have a high percentage of for-profit hospitals too, that are not subject to the charity care provisions of the ACA. But that said, the uninsured rate in the south is definitely connected to the lack of Medicaid expansion and connected to the increasing levels of medical debt in that region.”

Senator Warnock: “So you see a direct link between medical indebtedness in states like Georgia, and its refusal to expand Medicaid?”

Ms. Haynes: “Absolutely. Last stat I believe said that Georgia has the fourth highest or third highest uninsured rate in the country. I have worked with clients directly in Georgia, who are underinsured or uninsured facing medical debt and trying to figure out whether they need to file bankruptcy, trying to figure out how they can negotiate some sort of payment plan. It is definitely at crisis levels in states like Georgia.”

Senator Warnock: “Medicaid expansion is something I’m focused on and I’ll keep pushing for that. But also capping the cost of prescription drugs, which would be helpful. According to the Kaiser Family Foundation, nearly 1 in 10 adults, or roughly 23 million people, owe medical debt. And as of 2020, American families collectively owed over $140 billion in medical debt. In Georgia, there’s over $120 million in medical debt for over 108,000 folks. This is unacceptable. People should not have to choose between getting the prescription drugs they need and groceries.”

A copy of the letter to the CFPB is available here and below.

Dear Director Chopra:

We write to encourage the Consumer Financial Protection Bureau (CFPB) to use its authority to address the growing medical debt burden faced by U.S. consumers, including by creating an ombudsman position for consumer medical debt. Accessing medical care is a necessity that has resulted in too many Americans facing overwhelming bills, harassment from debt collectors, and the long-term effects of negative credit actions.

As highlighted in the CFPB’s recent report, Medical Debt Burden in the United States, there is $88 billion in medical debt on consumer credit records, and that staggering number is likely lower than the total amount of medical debt in collections. Medical debt is currently the most common debt collection tradeline on credit records, and that debt burden is not evenly held. Low-income individuals, Black and Hispanic households, veterans, young adults, and older Americans are more likely to have medical debt and struggle to pay it off. This debt burden exacerbates the racial wealth gap and cyclical poverty and places undue strain on already vulnerable populations.

Incurring medical debt can result in a host of adverse long-term effects for consumers like garnished wages or property liens. The effects of medical debt can extend beyond financial issues, creating a negative impact on mental and physical health. Medical debt collections can result in litigation, and in some concerning situations, those unable to pay have been sent to jail, marking the return of debtors’ prisons to our country.

During this once-in-a-generation pandemic, we’ve seen business entities take on a larger role in servicing vulnerable populations, often focusing on increasing profit and their bottom line over ensuring the health and wellness of American families. In the past, hospitals and nursing homes were generally non-profit entities or owned by healthcare providers. This recent trend in private equity investing in a larger portion of the healthcare market is troubling given reports that many patients see surprise medical bills after visiting a private-equity owned institution. In many cases, private-equity owned health care providers charge higher rates for the same services, deliver lower quality care – often with less staff, and maintain higher operating margins; we are concerned in the increased presence of private equity in healthcare is contributing to the growing medical debt burden.

In order to curtail the considerable adverse effects faced by consumers holding medical debt burdens, we respectfully ask that the CFPB consider using its authority to stem unfair medical debt collection practices and ease the strain felt by consumers, through both additional research and the creation of a medical debt ombudsman position.

Additional research is needed to understand the full scope of issues surrounding the medical debt burden in the United States. We suggest further examining medical debt collection practices, particularly the steps taken before bills are sent into collection and the number of Americans jailed for inability to pay medical bills. It would be helpful to know the number of people against whom legal action is taken, including court summons, wage garnishments, liens, etc. The CFPB should also research the size of the debt selling market for medical bills, including information on the number and size of the debt buyers and the health entities most likely to sell medical debt. We also suggest further research into how consumers incur medical debt. We would like to better understand how private-equity owned institutions collect medical debt and report it to credit reporting companies, whether private equity companies have played a role in increasing medical debt accumulation across the board, and how private-equity owned revenue cycle management companies collect medical debt.

Finally, we encourage the CFPB to consider creating an ombudsman position for medical debt similar to the ombudsman position created to ensure student loan servicers complied with federal and state laws. This position could help to facilitate consumer complaint resolution and compliance with federal directives, like the recently implemented federal ban on surprise medical bills. An ombudsman can also monitor the changes announced earlier this month by Equifax, Experian, and Transunion, to ensure that the proposed change to medical debt credit reporting are uniformly and universally implemented.

We appreciate your prompt attention to this issue and look forward to working with you to protect consumers and patients from harboring this growing medical debt burden.

Sincerely,

###