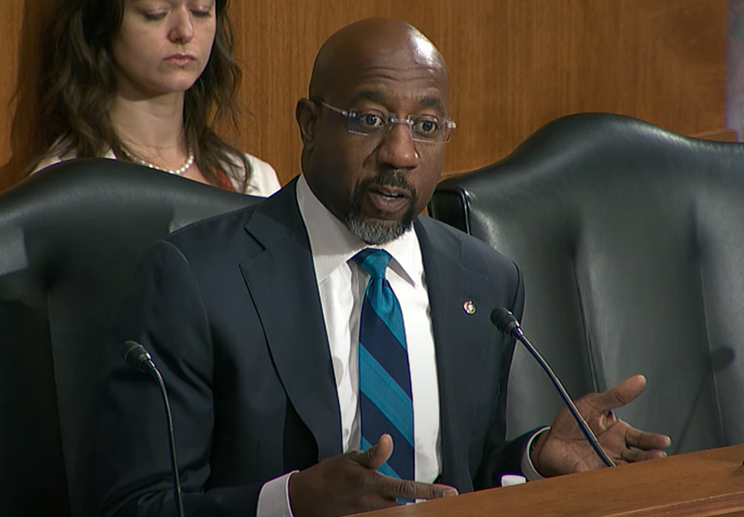

At a Thursday Senate Banking committee hearing, Senator Warnock questioned Christy Goldsmith Romero about her plans to foster and implement positive culture change at the Federal Deposit Insurance Corporation (FDIC), if confirmed as its Chair

President Biden nominated Romero after the current chair of the FDIC, Martin Gruenberg, announced he would step down following an investigation that detailed a toxic workplace at the agency

During the hearing, Senator Reverend Warnock’s questions highlighted Goldsmith Romero’s experience establishing a culture of respect at previous government agencies for employees

Senator Reverend Warnock closed his remarks expressing support for Romero’s nomination to be the next Chair of the FDIC

Senator Reverend Warnock: “I would hold him [Chair Gruenberg] accountable, and would hold anyone in that position accountable for the cultural and structural changes needed. I look forward to supporting your [nominee Goldsmith Romero] nomination and holding you accountable to turning the FDIC around”

Watch Senator Reverend Warnock at Thursday’s Banking hearing HERE

Washington, D.C. – Yesterday during a Senate Banking committee hearing, U.S. Senator Reverend Raphael Warnock (D-GA) questioned Christy Goldsmith Romero about her plans to change the culture at the Federal Deposit Insurance Corporation (FDIC) if she is confirmed as the agency’s next Chair. Goldsmith Romero was one of four nominees questioned by the committee. Senator Warnock is the Chair of the Senate Banking Subcommittee on Financial Institutions and Consumer Protection, which has jurisdiction over the FDIC.

Goldsmith Romero’s nomination from President Biden came after the FDIC’s current Chair, Martin Gruenberg announced his plans to resign following a report that detailed widespread and longstanding workplace toxicity that festered under his leadership for nearly two decades. The other nominees were Caroline A. Crenshaw, nominated to be a Member of the Securities and Exchange Commission, Kristin N. Johnson, a Georgia native and professor at Emory Law, to be an Assistant Secretary of the Treasury, and Gordon I. Ito to be a Member of the Financial Stability Oversight Council.

“Systemic and cultural issues have plagued the FDIC in recent years. It’s clear that senior leadership of the FDIC turned a blind eye, a blind eye to ongoing discrimination, harassment, and abuse and they failed to properly reprimand or terminate offenders,” said Senator Revered Warnock. “Simply, the FDIC failed to institute a culture of accountability and as a result, employee morale is low which has deep implications for the [FDIC’s] mission.”

During the hearing, Senator Warnock’s questioning highlighted Goldsmith Romero’s previous work as the Special Inspector General of the Troubled Asset Relief Program. Goldsmith Romero pointed to her efforts to establish a culture of respect at both the employee level and respect toward those she and her team were investigating. Senator Warnock acknowledged the monumental task of changing the culture at the FDIC if confirmed but closed his initial line of questioning supporting Goldsmith Romero’s nomination to become the next Chair of the agency.

Watch the Senator’s full remarks HERE.

See below the full transcript exchanges between Senator Warnock and Christy Goldsmith Romero:

Senator Reverend Warnock (SRW): “I’d also like to extend a special welcome to Commissioner Kristin Johnson who hails from the Great state of Georgia where she has served as a law professor at Emory University.

“Congratulations, Commissioner Johnson, and congratulations to your family. As we’ve discussed in this committee, systemic and cultural issues have plagued the FDIC in recent years.

“It’s clear that senior leadership of the FDIC turned a blind eye, a blind eye to ongoing discrimination, harassment and abuse and they failed to properly reprimand or terminate offenders.

“Simply, the FDIC failed to institute a culture of accountability and as a result, employee morale is low which has deep implications for the mission

“Ms. Goldsmith Romero, thank you for visiting with me yesterday, I enjoyed our conversation in my office to discuss your plans for the FDIC, if you are confirmed as its next chair, I appreciate it – your candor.

“The task you face, as you well recognize, is monumental. This is tough work, the FDIC plays a critical role in ensuring the safety and the soundness of our financial system and it needs an energized workforce in order to do that.

“What experience do you have changing organizational cultures? And how do you plan to draw on that experience at, at the FDIC?”

Christy Goldsmith Romero (CGR): “Thank you, Senator. I very much enjoyed our conversation in your office and talking through, these are tough issues.

“I came into SIGTARP, and it was primarily a law enforcement office, it was male-dominated, special agents who I have a great regard for because they put their lives on the line. But I would say sometimes the level of professionalism, the language and all of that was not at the level that I thought was appropriate, particularly for an IG’s office.

“One of the things I came in and did was raise very high, this level of respect and this level of professionalism, this level of dignity by which we would treat each other, but also how we would refer to those we were investigating and anyone that we were coming in contact with.

“So that organizational change, and being able to do that, and bring people along with that, so they didn’t fight me on it, but that they actually embraced it and moved in that direction. I think I would bring to the FDIC.”

(SRW): “As you expressed yesterday and expressed today, it was just part of the culture, this is just how it is.”

(CGR): “Yeah, I think cultures can change. I think you start with the tone at the top and what’s acceptable and you send clear messages as to what’s acceptable and what’s not.”

(SRW): “The Cleary report made seven recommendations for the FDIC ranging from protecting victims, improving policies, and holding leadership accountable for inaction.

“When Chair Grunberg came in front of the banking committee in May, he agreed to provide a written update and briefing to my sub-committee on the status of these recommendations.

“Ms. Goldsmith Romero, what is your sense of where the FDIC is in implementing these recommendations?”

(CGR): It’s hard for me to see on the outside, although I read some of the things that are happening on the website, but I’m very committed to being, transparent with you and communicating with you as, as part of your chair[menship] of the subcommittee.”

(SRW): “I made it clear to him in no uncertain terms, that as chair of Consumer Protection and Financial Institutions, I would hold him accountable and would hold anyone in that position accountable for cultural and structural changes needed, and I look forward to supporting your nomination and holding you accountable to turning the FDIC around. Certainly, you bring the kind of experience that we need at this particular, moment.

“A common theme in the post mortems of the bank failures last spring was that there was a brain drain at the FDIC that led to a lack of seasoned and competent bank examiners which helped prevent issues from being caught early.

“At the time this was attributed to low pay and difficult working conditions. We now know that the FDIC failed to protect junior employees, particularly women and people of color from harassment and retaliation and failed to punish the wrongdoers.

“How will you ensure examiners feel empowered while also working to recruit to retain and support examiners, specifically examiners who are women and people of color?”

(CGR): “First, we’ve got to make sure that they feel safe, We got to make sure there’s a good process that they trust that they can raise these complaints. And then we have to empower examiners in other ways that allow them to be nimble that allow them to use their judgment and their expertise and experience.

“I do want to be able to recruit to, to deal with the issues of the workforce and how long some of them have been [there] and we the need to bring more in.

(SRW): I think all of this underscores the ways in which these issues that we’re raising around the culture, around accountability, abuse, harassment, that these aren’t extraneous to the mission. They’re, they are central to the ability FDIC to carry out its mission for employee morale, for folks to remain focused on the work that we require them to do, need them to do, in order to protect our financial system.”

###