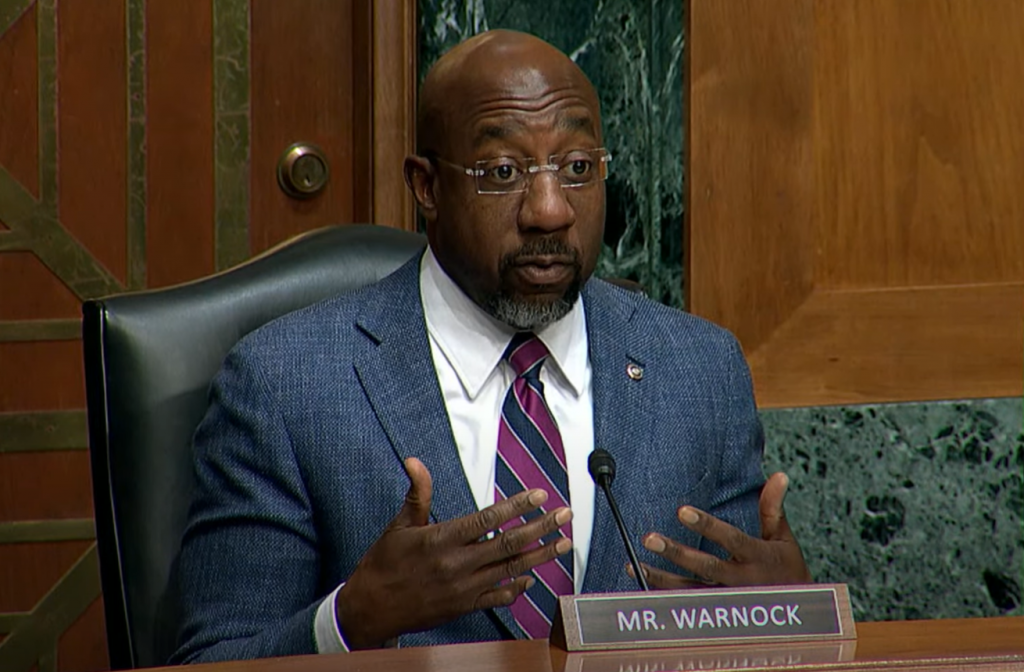

At a Wednesday Senate Banking committee hearing, Senator Warnock questioned the Consumer Financial Protection Bureau (CFPB) Director Chopra about the benefits of removing medical debt from credit reports

Senator’s questioning follows his push earlier this year urging the Biden Administration to address the burden of medical debt on hardworking families

Earlier this week, the Biden Administration announced a proposed rule that would remove individuals’ medical debt from their credit reports, making it easier to qualify for a home mortgage or car loan

During the hearing, Senator Reverend Warnock highlighted a CFPB finding that roughly 27% of rural Georgians have medical collections on their credit report, ten percentage points higher than the national average

Senator Reverend Warnock: “I often say that is tis expensive to be poor, and this is an example of that. People burdened by medical debt dragging down credit score, the cost of money goes up”

Watch Senator Reverend Warnock at Wednesday’s Banking hearing HERE

Washington, D.C. – Yesterday during a Senate Banking committee hearing on the Consumer Financial Protection Bureau (CFPB), U.S. Senator Reverend Raphael Warnock (D-GA) highlighted the strain medical debt puts on American families when it is included in credit reports and cheered the Biden Administration’s recent actions—following his urging—to address the burden of medical debt. During the hearing Senator Warnock, who chairs the Senate Banking Subcommittee on Financial Institutions and Consumer Protection which has jurisdiction over the CFPB, questioned CFPB Director Rohit Chopra about the growing issue of medical debt that appears on American credit reports, highlighting how it has been used to deny some Americans loans for houses or cars.

Shortly before the hearing the CFPB announced a proposed rule that would block medical debt from appearing on most credit reports, following Senator Warnock’s March 2024 letter with nine other senators urging the CFPB to protect Americans from predatory medical debt collection practices. Additionally, the Senator highlighted his bipartisan Insulin Desert Report, published last year, noting that nearly half of the counties that are Insulin Deserts also have high rates of medical debt. He also cited CFPB research findings that roughly 27 percent of rural Georgians had medical collections on their credit reports— ten percentage points higher than the national average.

“I often say that it is expensive to be poor, and this is an example of that. People burdened by medical debt dragging down credit scores, the cost of money goes up,” said Senator Reverend Warnock. “This is something we’ve been pushing on, I applaud you for proposing this rule, which would be life-changing for so many people across the country, certainly throughout the South, who are drowning in medical debt and bad credit, often while dealing with health challenges on top of this. This is enough to make anybody sick and sicker.

Senator Warnock also used his questioning during the hearing to discuss the need for additional consumer protections in the “buy now, pay later” (BNPL) market. In December, Senator Warnock sent a letter to Director Chopra urging him and the CFPB to monitor the risks posed by BNPL products.

Watch the Senator’s full remarks HERE.

See below a transcript of key exchanges between Senator Warnock and Director Chopra:

Senator Reverend Warnock (SRW): “Let me start by sharing how glad I am, Director Chopra, that the CFPB’s funding structure is still intact. I was happy to join my colleagues in an amicus brief to the Supreme Court protecting the Bureau and I’m glad they got that right.

“Yesterday the Consumer Financial Protection Bureau announced a proposed rule that would block medical debt from appearing on most Americans’ credit reports. The last time you appeared before this committee we discussed this bipartisan report that I released not long ago on Insulin Desert counties with both high rates of Americans who are uninsured and high rates of Americans who have diabetes.

“We see these counties across the United States, concentrated largely in the South, but by no means exclusively in the South. High rates of uninsured people, high rates of diabetes.

“Director Chopra, do you know how many of these insulin deserts also have high rates of medical debt?”

Director Rohit Chopra (RC): “We do believe this is disproportionately harming some of those communities, especially in the South. I think it’s tragic where we have a system where people can be really punished over and over again for health issues and in a way that can destroy their financial life.

“Medical debts can contribute to bankruptcy, can contribute to so much loss of income. I do think what we’ve proposed is an important step to a little bit put a stop to some of this.”

(SRW): “My data shows that nearly half of these insulin deserts also have high levels of medical debt. In the state of Georgia, still digging in its heels, refusing to expand Medicaid, you’ve got the working poor who are burdened by all this medical debt, uninsured, all these issues converging on families at the same time.

“In Georgia, 27% of rural residents have medical collections on their credit report, 27%. That’s six percentage points higher than the rate among all Georgians, ten percentage points higher than the national average.

“How would folks, in the South especially, benefit from the CFPB proposed rule banning medical debt from credit reports?”

(RC): “We expect that it will materially help their lives. In many cases, if medical debt is the only thing on their credit report, it will materially increase their credit score.

That means really the cost of so many other loans, auto loans, credit cards would go down for them. More importantly, they wouldn’t be dealing with adding insult to injury when it comes to their health conditions.

(SRW): “This would have a material impact, obviously, on the lives of families. I often say that it’s expensive to be poor and this is an example of that. People burdened by medical debt dragging down credit scores, the cost of money goes up.

(RC): “This is a cycle we have to stop.”

(SRW): “Thank you so very much, this is something we’ve been pushing on. I applaud you for proposing this rule, which would be life-changing for so many people across the country, certainly throughout the South, who are drowning in medical debt and bad credit, often while dealing with health challenges on top of all this. This is enough to make anybody sick and sicker.”

###