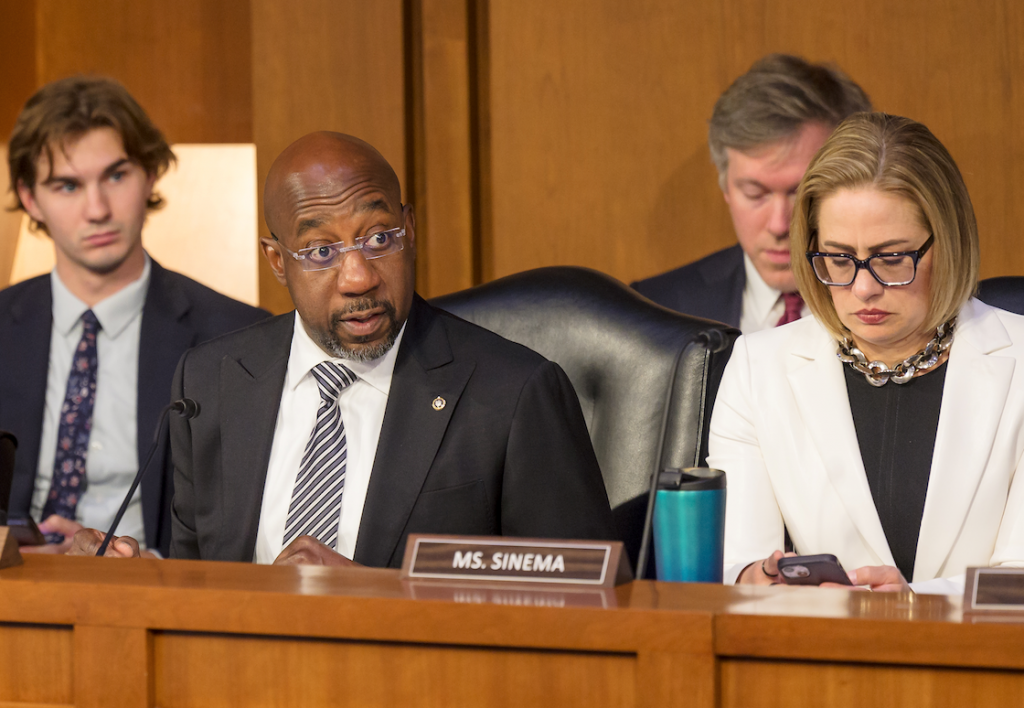

In Senate Banking committee hearing, Senator Reverend Warnock advocated for Georgia’s small businesses as he questioned nominees for positions on the Federal Reserve, including Dr. Lisa Cook, who is up for a full term on the Board of Governors of the Federal Reserve System

Dr. Cook is a Milledgeville, Georgia native and Spelman College graduate

During the hearing, Senator Reverend Warnock elevated the concerns of Georgia small businesses in a climate of high-interest rates and pushed the Federal Reserve to better support small community lending institutions

Senator Reverend Warnock: “With higher interest rates and tightening credit conditions, small businesses, especially, are having trouble finding loans to help fund their growth. Meanwhile, the giant banks are spending billions on buybacks, while their consumer and small business banking revenue has sharply increased, taking money straight from Georgia’s communities and delivering it to their wealthy shareholders”

Washington, D.C. – This week, U.S. Senator Reverend Raphael Warnock (D-GA) championed Georgia’s small businesses and small lending institutions and uplifted the concerns of consumers during a Senate Banking committee hearing with nominees for positions on the Federal Reserve. These nominees, including Dr. Lisa Cook, a Milledgeville, Georgia native and Spelman College graduate, who is up for a full term on the Board of Governors of the Federal Reserve System. Dr. Cook was previously confirmed to the Federal Reserve Board and made history as the first Black woman to be on the prestigious and important panel that helps promote a robust American economy.

See here for key excerpts of Senator Warnock acknowledging the qualifications of the nominees and uplifting the concerns of Georgia’s small businesses:

“We have before the committee three outstanding and historic nominees to the Federal Reserve, who are all eminently qualified to apply their efforts to abide by the Fed’s dual mandate to maximize employment and manage inflation. They will further help the Board reflect the diversity of our great nation and are also all ready to maintain the safety and the soundness of our financial system.”

“Georgia banks are sound in terms of their expertise to lend to their communities, but they’re having to carefully navigate higher rates and maintain consumers or customers confidence following the failures of banks in other parts of the country.”

“With higher interest rates and tightening credit conditions, small businesses, especially, are having trouble finding loans to help fund their growth. Meanwhile, the giant banks are spending billions on buybacks, while their consumer and small business banking revenue has sharply increased, taking money straight from Georgia’s communities and delivering it to their wealthy shareholders.”

Senator Warnock is a steadfast supporter of Georgia’s small businesses, has worked hard to foster a financial climate that will bolster the Georgia economy, and has pushed the Federal Reserve to best serve the interest of Georgians. In December of 2022, Senator Warnock announced he secured nearly $200 million in federal funds to increase access to capital and promote entrepreneurship for small businesses in Georgia. Senator Warnock has introduced legislation to protect small businesses from security breaches, and has championed the expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit, in order to provide families a tax cut so that they are able to spend at local small businesses. In March of this year, Senator Warnock pushed Federal Reserve Chair Jerome Powell to assist hardworking Georgians who are struggling to secure affordable housing across the state as the Fed considered raising interest rates. Senator Warnock is also proud to be a founding member of the Senate Community Development Finance Caucus (CDFC), a bipartisan caucus dedicated to boosting small businesses in underserved communities.

###