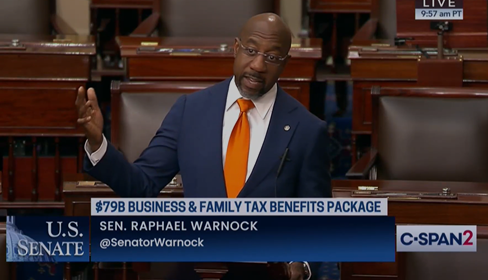

Highlighting the benefits of tax cuts for working and middle-class families, Senator Reverend Warnock gave a speech on the floor of the U.S. Senate before the failed passage of the Tax Relief for American Workers and Families Act

The failed Tax Relief for American Families and Workers Act, supported by Senator Reverend Warnock, would have expanded the popular Child Tax Credit

The bill failed with a final vote of 48-44, needing 60 votes to pass

Senator Reverend Warnock: “The expanded Child Tax Credit is a part of that good public policy, centering ordinary people, we strengthen their families, and we strengthen the American economy. The time to do that is now”

Watch the Senator’s floor remarks HERE

Washington, D.C. – Today, U.S. Senator Reverend Raphael Warnock (D-GA) delivered remarks on the U.S. Senate floor before the vote on the Tax Relief for American Works and Families Act. The bill, needing 60 votes to pass, failed in a final vote of 48-44, if passed the bill would have expanded the Child Tax Credit (CTC). In his remarks, the Senator, a product of good public policy, highlighted how bills like the Child Tax Credit improve the American economy, help to lift families out of poverty, and improve the lives of millions of children nationwide.

“I grew up in public housing, and I wouldn’t be standing here today if it were not for good federal public policy. I worked hard, I put my shoes on every morning, I come from a family that emphasized a strong work ethic. But I needed all of that and good federal public policy to be standing on this floor right now,” said Senator Reverend Warnock. “The expanded Child Tax Credit is a part of that good public policy, centering ordinary people, strengthen their families, and we strengthen the American economy. The time to do that is now.”

Senator Warnock is a steadfast champion of working families and legislation that seeks to reduce child poverty. Senator Warnock fought to secure the Expanded Child Tax Credit as part of the American Rescue Plan. Building on that work, Senator Warnock has advocated to make the expanded CTC permanent in the effort to slash child poverty in Georgia and across America.

The full transcript of Senator Warnock’s remarks is below:

“Mr. President, I rise today with deep antipathy and disappointment for the persistent political games being played in this chamber. And as a pastor, I am particularly bothered when those games are played with children.

“Today, by all accounts, the Senate will fail to pass legislation with strong bipartisan support, that will make a serious difference in the lives of everyday Georgians and their children. We’re on track to do the right thing by our children. But once again politics, as we enter the silly season of politics, is getting in the way.

“Extending the expanded Child Tax Credit is not only the right thing to do morally, it is the smart thing to do, economically. And I have to say that I find that often that is the case with our public policy, very often the right thing to do is also the smart thing to do. And it’s politics and politics alone that gets in the way.

“Were it not for the cynical politics of Washington. Passing this bill would be a no-brainer. And the moral question that we have to ask ourselves is, are we so focused on the next election that we can’t focus on the next generation?

“It’s beyond nonsensical, that there are some who have previously preached about the importance of lowering taxes. But they’re getting ready to vote down a tax cut for middle and working-class families. And I think it’s important to underscore that point because I recognize that the folks who are at home when they hear words like tax credit, expand the Child Tax Credit, they’re engaged in their work. They may not readily know what we’re talking about it is a tax cut. That’s what it is, a tax cut for middle and working-class families. And when we passed it, back in 2021, it was in fact, the largest tax cut for middle and working-class families in American history.

“But now we’ve got the same lawmakers who love to talk about the need to lower taxes on middle and working-class Americans. An argument I hear often, they’re getting ready to vote down this tax cut. And so the next time that I hear them talking about the need to cut taxes, I’m going to ask my colleagues, how did you vote today? How’d you vote when you had an opportunity to provide tax relief for ordinary people? Maybe the issue is not so much tax cuts, it’s for whom?

“Is it for those who need it the least or those who could benefit from it the most? The bipartisan tax relief bill negotiated in good faith by my friend, the senior senator from Oregon, is legislation that will offer a helping hand to ordinary families because we know that when ordinary people thrive, the economy thrives. And the reason the economy thrives is because when people who do not have a lot of disposable income, or virtually no disposable income, when they get a little bit of relief, they buy extravagant things, like a coat for their kid for winter, some more food, an opportunity to get some after-school enrichment.

“So that’s what I think about, I think about a mom that I met in Columbus, Georgia named Denise, who in the weeks after we passed the expanded Child Tax Credit, she said to me, Senator, I’m so grateful that you all got this done. She said that she used those extra dollars to help prepare her daughter to go back to school and to help take care of her household as she was transitioning between jobs. It was a win for her, a win for her daughter, a win for the American economy.

“Let’s be clear. The bill that we’re taking up today would help reduce poverty for some 636,000 children in Georgia and their families. And if I’m honest, it’s the kind of work that spurred me, a pastor to get involved in politics in the first place. I put up with politics in order to do things like this.

“When we passed the expanded Child Tax Credit, we literally cut child poverty 40% or more in America, but because we only did it for six months, we went back and doubled it. We can do better than that. And so these dollars are going right back into the economy, helping small businesses and helping local economies to be stronger. So we’re helping families, helping businesses, helping our economy.

“Not only that, but we know that the smartest investment we can make is investing in our children. When we invest in our kids, especially in getting them out of poverty, we literally save them from the trauma, the actual trauma that poverty creates. I stand advocating, pushing, begging my colleagues to reconsider.

“You know, I grew up in public housing, and I wouldn’t be standing here today if it weren’t not for good federal public policy. I worked hard, I put my shoes on every morning, I come from a family that emphasized a strong work ethic. But I needed all of that and good federal public policy to be standing on this floor right now. I am the beneficiary of Headstart, which by the way, Project 2025 wants to go after, Headstart which gives poor children access to literacy, sets the foundation for good life. In high school, another good federal program called Upward Bound put me on a college campus during the summer and every Saturday, so I knew that I belonged on the college campus. And then Pell Grants and low-interest student loans, ensure that I could make my way through college.

“The expanded child tax credit is a part of that good public policy, centering ordinary people, we strengthen their families, and we strengthen the American economy. The time to do that is now. The time now is not to focus on November but to focus on what we can do right now. Dr. King was right, ‘the time to do right, is always right’. And that time is right now.”

###