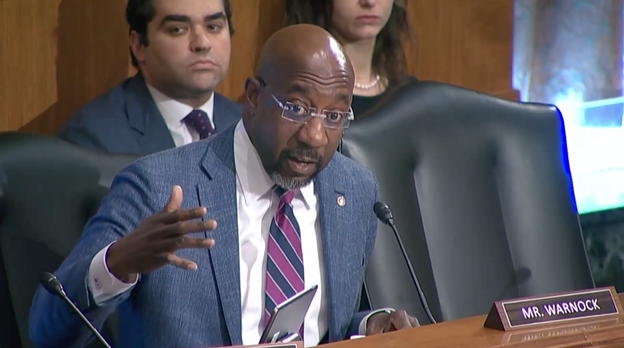

At Thursday’s Senate Banking Committee hearing, Senator Reverend Warnock questioned Treasury Secretary Janet Yellen on the economic benefits of an expanded Child Tax Credit (CTC), Medicaid expansion

Senator Reverend Warnock probed Secretary Yellen about how family finances can increase through policies like the CTC

Senator Reverend Warnock also questioned Secretary Yellen about the financial benefits and improved care outcomes for states that have adopted Medicaid Expansion

As 640,000 vulnerable Georgians struggle to access affordable quality health care, Georgia is one of 10 states that have not adopted Medicaid expansion

WATCH: Senator Reverend Warnock’s questions from Banking Committee hearing —VIDEO HERE

Washington, D.C. – Today, U.S. Senator Reverend Raphael Warnock (D-GA) continued his push for a renewed Child Tax Credit (CTC) and Medicaid expansion during a Senate Banking, Housing, and Urban Affairs Committee hearing. The hearing, focused on the annual Financial Stability and Oversight Council Report and featured Treasury Secretary Janet Yellen as a witness. Senator Warnock questioned Secretary Yellen on the economic benefits, for both states and families, of the Child Tax Credit (CTC) and Medicaid expansion.

“The Child Tax Credit was a tax cut that put money in family’s pockets. What economic benefits do we see from policies like this that focus on reducing childhood poverty, including family’s ability to save,” said Senator Reverend Warnock.

“Can you discuss how state economies have improved post [Medicaid] expansion, specifically compared to non-expansion states, like Georgia,” Senator Reverend Warnock asked earlier in the hearing.

Senator Warnock is a steadfast champion of working families and legislation that seeks to reduce child poverty. Last year, Senator Warnock introduced the Working Families Tax Relief Act, legislation that would cut taxes for workers and families by expanding the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). He also fought to secure the Expanded Child Tax Credit as part of the American Rescue Plan. Building on that work, Senator Warnock has advocated to make the Expanded CTC permanent in the effort to slash child poverty in Georgia and across America. Over 2 million children in Georgia would benefit from the expanded CTC found in that legislation. Passing the Working Families Tax Relief Act will help boost Georgia’s economy as more money is put in the hands of middle- and working-class families.

Senator Reverend Warnock has long championed efforts to expand affordable health care access, starting with his advocacy to close the health care coverage gap in Georgia. In addition to pushing for solutions to close the coverage gap, the Senator is committed to preserving and protecting access to health care for the most vulnerable. In 2022, the Senator led a delegation of Georgia lawmakers in urging the Center for Medicaid and Medicare Services (CMS) to provide tools to Medicaid non-expansion states like Georgia to help them protect health care access for Medicaid enrollees who lose eligibility after the public health emergency declaration ends. Last year, Senator Warnockalso urged the CMS to ensure that the gains made in reducing the number of uninsured children are not lost as states begin to unwind some Medicaid policies that have been in place since the start of the COVID-19 public health emergency.

Last month, Senator Warnock made his first visit to Georgia’s legislative session as a U.S. Senator to meet with Georgia state lawmakers in both parties and discuss their priorities. During his visit he touched on several issues impacting Georgians but highlighted the need to expand Medicaid to close the health care gap for more than 640,000 Georgians.

See below key excerpts from Senator Warnock’s line of questions during the Banking Committee hearing:

Senator Warnock: “The Child Tax Credit and the Earned Income Tax Credit, which I helped pass through the American Rescue Plan was transformational for millions of Americans, reducing the number of kids living in poverty by more than 40%. All these provisions collectively lifted nearly 10 million children above the poverty line, or just slightly below the poverty line.

SRW: “These funds helped Georgians buy essentials like food, diapers, or coats for their kids, lifesaving prescription drugs. But unfortunately, these provisions expired, and we lost the dramatic gains we made in combating childhood poverty.

SRW: “Secretary Yellen, what economic benefits do we see from policies like this that focus on reducing childhood poverty, including family’s ability to save?”

Secretary Yellen: “I think it had an utterly dramatic effect on households, as you mentioned. It resulted in a massive reduction on child poverty. […] Families had the resources to support their children, to make sure that they weren’t deprived of food and other support that they need to go on and lead good lives and be productive.

SY: “It’s a tremendously important support.”

SRW: “It has been 14 years, since the passage of the Affordable Care Act, yet 10 states, including Georgia, have not fully expanded Medicaid. Let me be clear, closing the healthcare gap is the right thing to do, but it is also the smart thing to do. It’s good for our economy, in fact a recent report from the Council of Economic Advisors concluded that Medicaid expansion increases the disposal income of those gaining health coverage.

[Watch the Senator’s full line of questions HERE.]