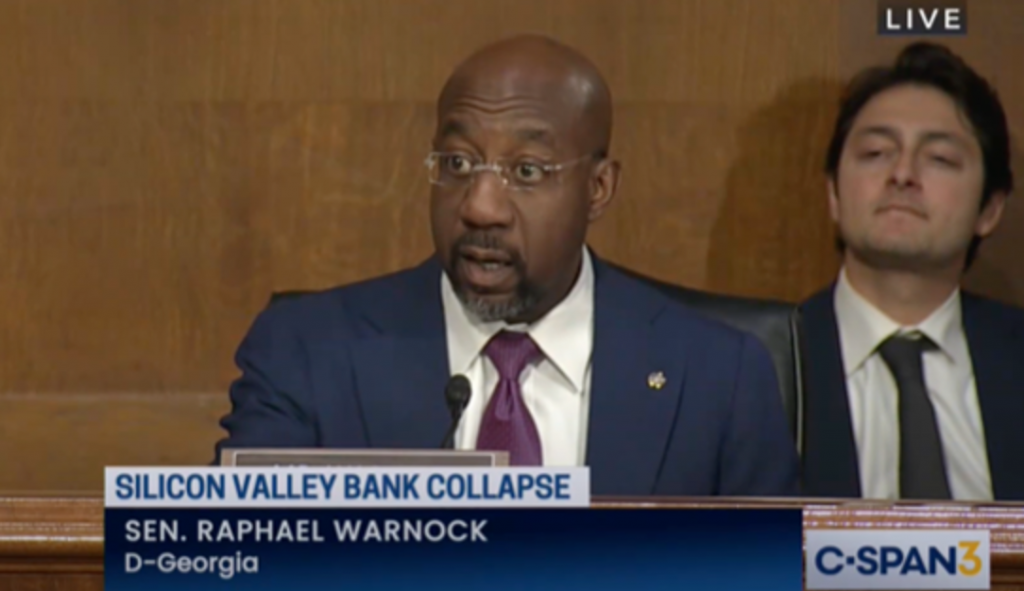

Senator Reverend Warnock urged the Chair of the Federal Deposit Insurance Corporation (FDIC) to ensure former Silicon Valley Bank executives are held to account at Banking Committee hearing focused on recent bank failures

Senator Reverend Warnock: “When bankers make risky bets that threaten our entire economy, they got to cash in. They should be held accountable”

Senator Reverend Warnock also pushed the FDIC Chair to better protect ordinary Americans from overdraft and non-sufficient fund fees which might have been incurred at no fault of their own

Senator Reverend Warnock: “Here is the bottom line: ordinary folks who just showed up, put their deposits [in], they shouldn’t have to bear the brunt of these bad decisions made by bank executives”

Washington, D.C. — Today, during a hearing of the U.S Senate Banking committee focused on recent bank failures and the subsequent federal regulatory response, U.S. Senator Reverend Raphael Warnock (D-GA) pressed Martin Gruenberg, Chair of the Federal Deposit Insurance Corporation (FDIC) to provide specific details to ensure former Silicon Valley Bank (SVB) executives are held to account in the wake of the bank’s recent failure. Senator Warnock also pushed for better protections for ordinary Americans from overdraft and non-sufficient fund fees, which might have been incurred at no fault of their own because of SVB’s collapse.

“When bankers make risky bets that threaten our entire economy, they got to cash in,” said Senator Reverend Warnock regarding the need to hold SVB executives to account. “They should be held accountable.”

“As a result, some of the sixty-four million Americans living pay check to pay check were hit with overdraft, non-sufficient funds fees due to the disruption. Something I’ve addressed in other settings,” said Senator Reverend Warnock. “And that’s why I sent a letter with Senator Booker urging regulators to impose a temporary moratorium on overdraft and non-sufficient funds fees for folks who incurred these fees at no fault of their own.”

Last week, Senator Warnock urged regulators to set a temporary moratorium on overdraft and nonsufficient fund fees and urged the CEOs of the ten banks generating the most revenue from these fees to waive them for their customers in the wake of the failures of Silicon Valley Bank and Signature Bank this month, which led to disruptions across the financial sector. In a statement last week, Senator Warnock reaffirmed his confidence in the stability of the community banks and credit unions that provide security to so many Georgians. Senator Warnock has long been pushing to lower bank fees for Georgians. In October, Senator Warnock’s work to curb predatory bank fees gained significant momentum following the Consumer Financial Protection Bureau’s (CFPB) announcement that the agency would take steps to protect Georgians from junk fees, including surprise overdraft fees. In September, Senator Warnock directly pushed the heads of Wells Fargo, JPMorgan Chase & Co., U.S. Bancorp, and the PNC Financial Services Group to eliminate onerous and confusing overdraft fees.

See below key highlights from Senator Warnock’s Banking Committee Hearing:

“Many Americans, in fact all of us, would remember the unfairness of 2008, and that crisis, when bankers who made bad decisions, played games with our economy. Not only did they not go to jail, they got to keep their jobs and their multi-million dollar salaries. I feel that in a particular way, as someone who pastors and moves in communities where poor and marginalized people have the weight of the law come down on them for the smallest of infractions. Not one banker went to jail, and they kept their multi-million dollar salaries.”

“When bankers make risky bets that threaten our entire economy, they got to cash in. They should be held accountable.”

“We discovered shortly after regulators took control of Silicon Valley Bank that top executives at the bank offloaded millions of dollars’ worth of stock in the weeks leading up to the collapse — very convenient— including their former CEO who sold $3.6 million worth of stock two weeks before the bank crashed.”

“There is a scenario where these executives not only get away scot-free, but also with sizable paydays. And the FDIC should use every tool it has at its disposal to prevent it — we certainly don’t want to incentive this behavior.”

“For several days, payroll providers banking with SVB or Signature Bank had no way to access their deposits, everyday folks, leading to many Americans receiving their paychecks late or having missing paychecks. Too many Americans live paycheck to paycheck. And in this case, they got it late”

“And as a result, some of the sixty-four million Americans living paycheck to paycheck were hit with overdraft, non-sufficient funds fees due to the disruption. Something I’ve addressed in other settings.”

“And that’s why I sent a letter with Senator Booker urging regulators to impose a temporary moratorium on overdraft and non-sufficient funds fees for folks who incurred these fees at no fault of their own.”

“Here is the bottom line: ordinary folks who just showed up, put their deposits [in], they shouldn’t have to bear the brunt of these bad decisions made by bank executives.”

###